Standing instruction allows you to transfer money from one account to another at certain intervals. It can be used for various purposes, such as paying bills, investing in schemes (like NPS, PPF), etc.

State Bank of India (SBI) has made it easier to set Standing Instructions online through their official net banking portal at onlinesbi.sbi.

ADVERTISEMENT

In this article, you will get to know the following points on how to set Standing Instructions online,

Let’s see each of these points in detail.

Details required to set Standing Instructions in SBI Online

You need the following details to set Standing Instructions on your SBI account online,

- Registered mobile number.

- SBI Internet banking username and password.

ADVERTISEMENT

In case you have forgotten your Internet Banking details, you can find your username and reset your password online.

Steps to set Standing Instructions (SI) in SBI Online

To set Standing Instructions to any account through SBI net banking,

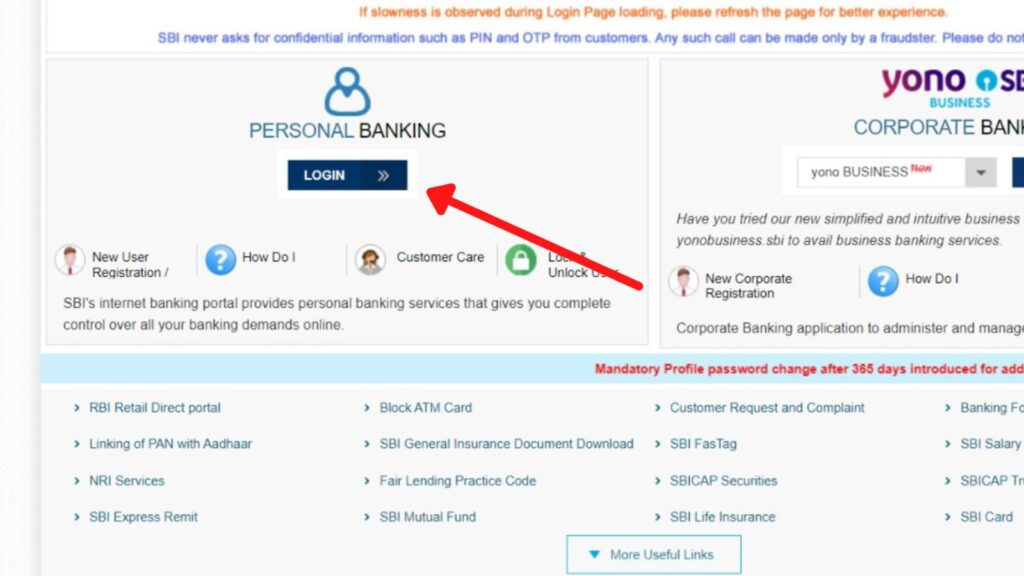

Step 1: Go to the official website of SBI Online

- First, go to the official website of SBI Internet Banking at onlinesbi.sbi

- Next, click on the ‘Login’ button under Personal Banking.

- Next, click on the ‘Continue to Login’ button.

- A new page opens up.

Step 2: Log in to your Internet Banking account

- On the new page, enter your internet banking username and password in the specified fields.

- Next, enter the captcha code and click on the ‘Login’ button.

- An OTP will be sent to your registered mobile number.

- Enter it in the specified field and click on the ‘Submit’ button.

- You will be logged in.

ADVERTISEMENT

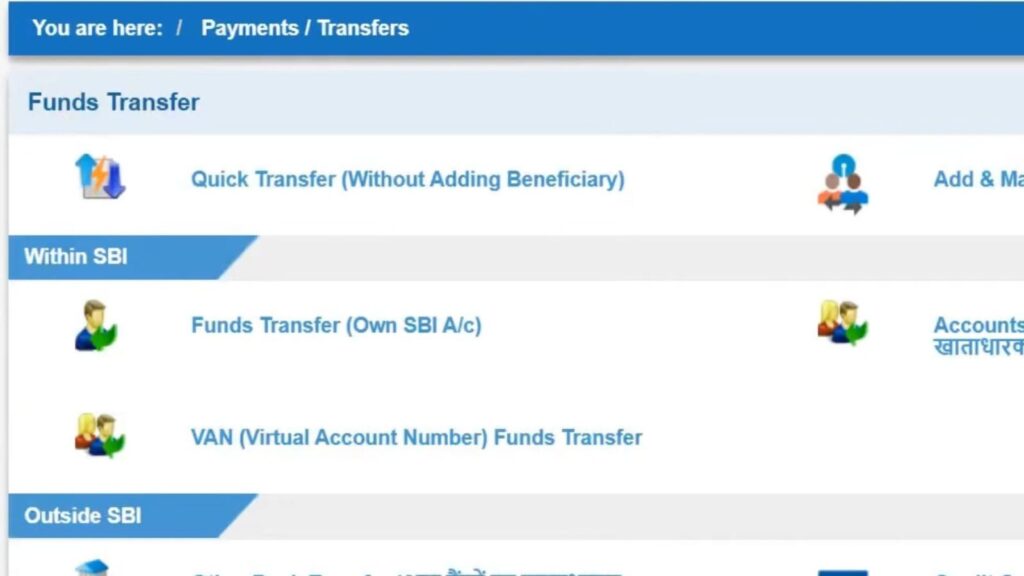

Step 3: Open the ‘Payment/Transfers’ option

- Next, click on the ‘Payment/Transfers’ option.

- Next, choose the ‘Fund Transfer (Own SBI A/c)’ option, if it is your own account. Choose the ‘Accounts of Others-Within SBI’ or ‘Other Bank Transfer’, if it is someone else’s.

- Make sure the account to which you want to send is added to your beneficiary list.

Step 4: Select the account

- Next, select the ‘Account No./Nick Name’ from which you want to make payment.

- Next, enter the ‘Amount’ in the specified field.

- Next, select the ‘Purpose’ from the drop-down list.

- Next, select the beneficiary to which you want to make payment from the list given.

- Next, select the ‘Standing Instruction’ from the ‘Payment Option’.

- More options will appear on the screen.

ADVERTISEMENT

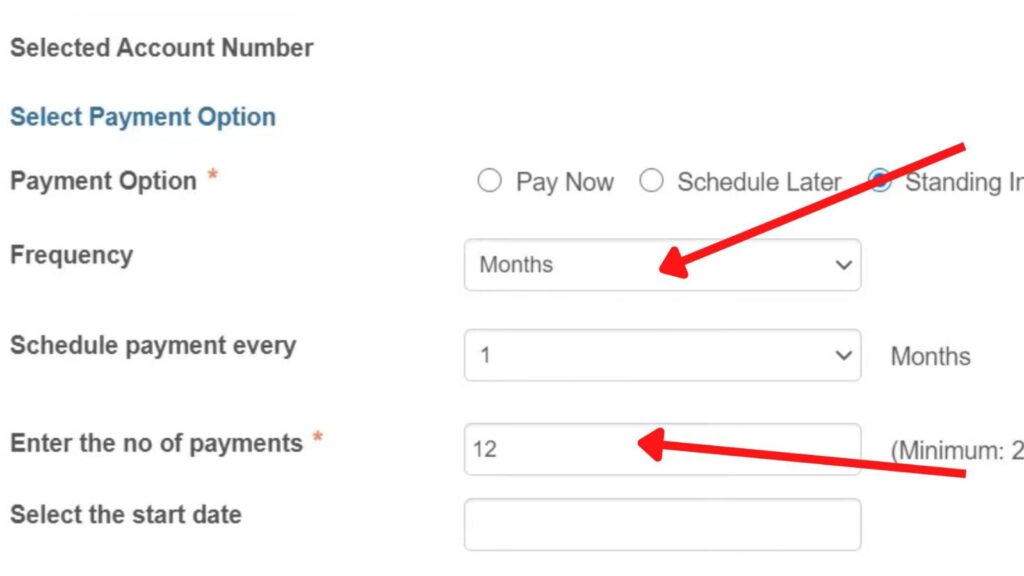

Step 5: Set Standing Instruction

- Next, choose and select ‘Frequency’.

- Next, select how often you need to make the payment from the ‘Schedule payment every’ option.

- Next, enter the ‘No. of payments’ in the specified field.

- Next, select the ‘Start Date’ from the calendar, which will appear by clicking on the specified field.

- Next, click on the ‘Submit’ button.

- Next, click on the ‘Ok’ button.

Step 6: Confirm Standing Instruction

- Next, click on the ‘Confirm’ button.

- Next, click on the ‘Ok’ button.

- A high-security Password (OTP) will be sent to your registered Mobile Number.

- Next, enter it in the specified field.

- Next, click on the ‘Confirm’ button.

Your Standing Instruction will be set successfully through SBI Net Banking.

By following these steps, you can easily set a standing instruction online in SBI through their net banking portal.

You can also create a Fixed Deposit or a Recurring Deposit (RD) account using the same portal.

More articles about Banking

- How To Block SBI ATM/Debit Card (Using OnlineSBI & Yono) 2024

- How To Stop SBI Cheque Payment (Using OnlineSBI & Yono) 2024

- How to Request SBI Cheque Book (Using OnlineSBI & Yono) 2024

- How to Download Balance Certificate from SBI Online 2024

- How To Open SBI Recurring Deposit (RD) Account Using YONO SBI

- How To Set Standing Instruction (SI) In SBI Using Yono Lite 2024

(Disclaimer: The information provided in this article is for educational purposes only. The screenshots/logos used are the intellectual property of the respective owners. dreamtrixfinance.com neither endorses nor is affiliated with the brands/websites mentioned. This is not financial advice.)