Road tax in India is paid by both private and commercial vehicles. It is often paid at the time of purchase of the vehicle. You can see it in the On-Road price of the vehicle. Some vehicles need to pay road tax on a yearly or quarterly basis.

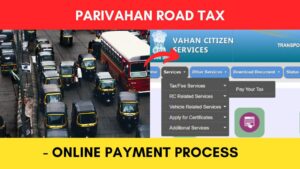

The MINISTRY OF ROAD TRANSPORT & HIGHWAYS has made it easier to pay road tax online through their official website parivahan.gov.in.

ADVERTISEMENT

In this article, you will get to know the following points about the road tax online payment process,

Let’s see each of these points in detail.

Details required to pay road tax online

The details of the vehicle required to pay road tax are,

- Vehicle registration number

- Vehicle chassis number

ADVERTISEMENT

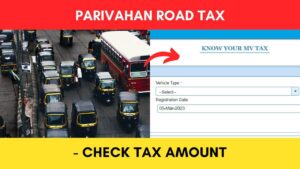

In case you want to know or verify the amount of tax that you need to pay for your vehicle, you can check that online by following the steps provided in the article below.

Click to know the steps to check your road tax amount online

Steps to pay vehicle road tax online

To pay your vehicle road tax online,

Step 1: Go to the official website of Parivahan

- First, go to the official website of Parivahan at parivahan.gov.in

- Then, go to the ‘Online Services’ option in the top menu.

- Then, click on the ‘Vehicle Related Services’ option.

- A new page will open up.

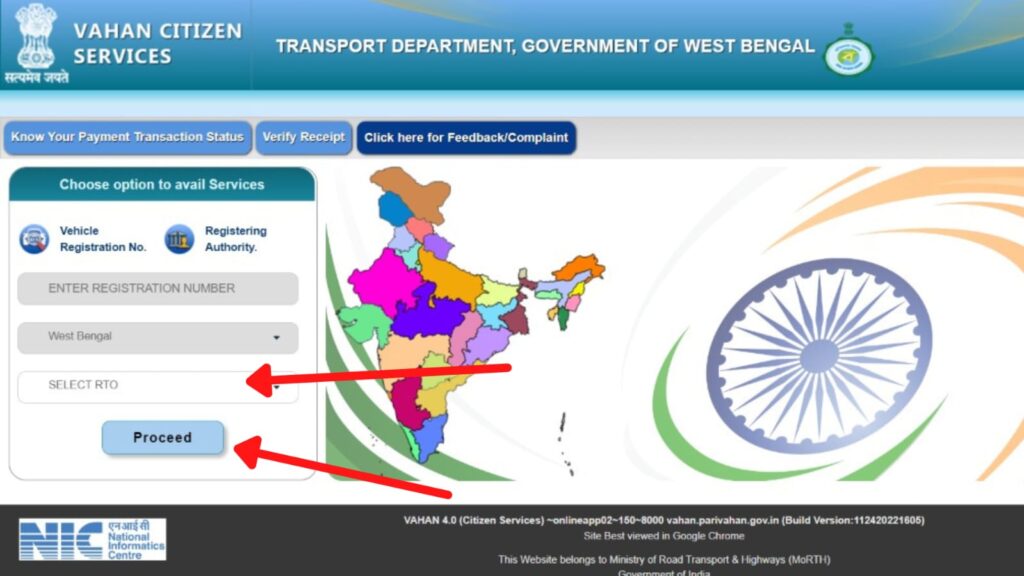

Step 2: Select your State and RTO

- On the new page, select your state. Now another page will open up.

- On that page, select your RTO from the drop-down list.

- Now, click on the ‘Proceed’ button.

- A popup will open. Scroll down and click on the ‘Ok’ button.

- A new page will open up.

ADVERTISEMENT

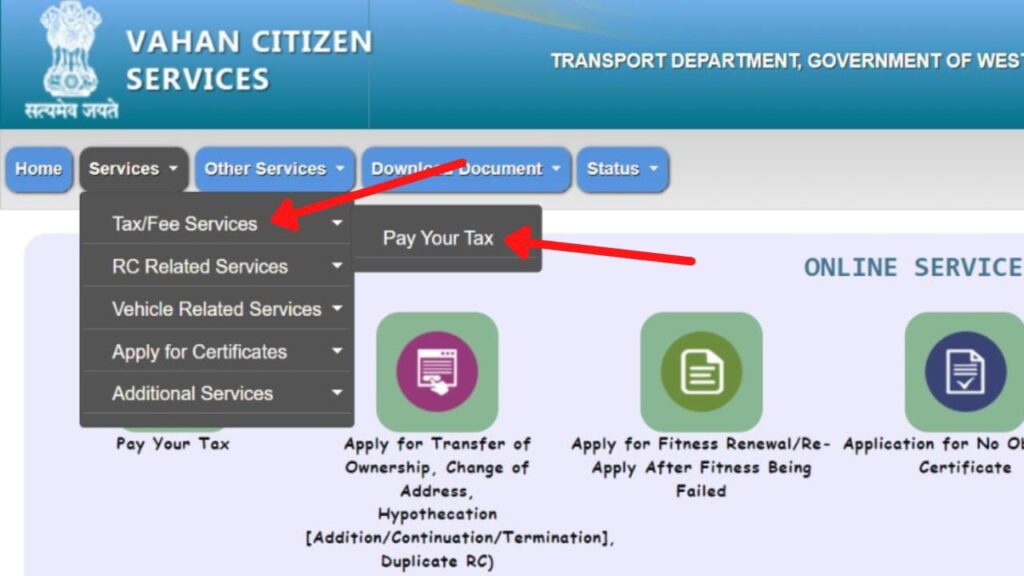

Step 3: Select the ‘Pay your Tax’ option

- Now on the new page, go to the ‘Services’ option on the main menu.

- Then go to the ‘Tax/Fee Services’ option.

- Then, click on the ‘Pay your Tax’ option.

- A new page will open up.

You can also directly click on the ‘Pay your Tax’ button situated on the dashboard to open the page.

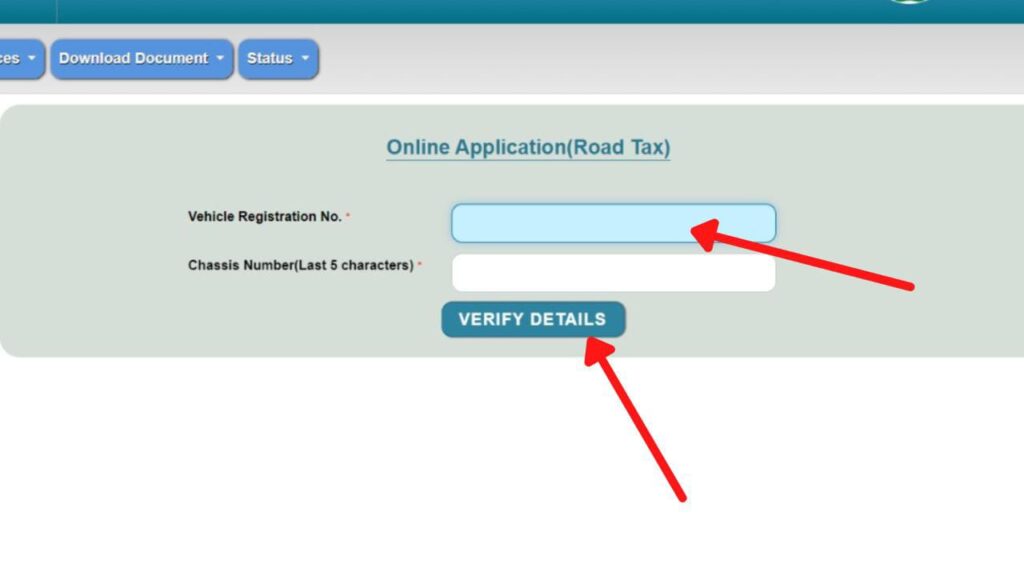

Step 4: Open the road tax form

- On the new page, enter your Vehicle registration number.

- Next, enter the last 5 characters of your Chassis Number.

- Next, click on the ‘Verify Details’ button.

- A new page will open up. (In case a popup window opens, select the Yes/No option as applicable).

- Now click on the ‘Submit’ button.

- The road tax form will open.

ADVERTISEMENT

Step 5: Fill out the road tax from

- On the new page, scroll down and enter the number of quarters/months/years you want to pay under ‘Tax details.’

- Now select the ‘Quarterly/Monthly/Yearly’ option from the drop-down menu for each sub-section under the tax section.

- The total tax will be calculated.

Step 6: Pay the road tax online

- Next, click on the ‘I Agree’ checkbox and click on the ‘Proceed’ button.

- Now select the payment gateway from the drop-down menu.

- Now, complete the payment process.

Once the payment is completed, you can download the payment challan.

You can then download the receipt by clicking on the ‘Receipt’ button. You can also take a printout or save the PDF of your payment receipt after being redirected to the Parivahan website.

By following these steps, you can pay the road tax on your vehicle online through the official website of Parivahan at parivahan.gov.in.

You can also check the status of your road tax payment online.

Click to know steps to check the road tax status

More articles about Tax

- Property (Holding) Tax Payment Process In West Bengal 2023

- Kolkata Municipal Corporation (KMC) Property Tax Payment Process

- Road Tax Online Payment Process For Your Vehicle 2023

- How To Know The Road Tax Amount On Any Vehicle Online 2023

- Road Tax Payment Status Check For Your Vehicle Online 2023