Property tax, also known as Holding tax, is a tax that is levied by your municipal corporation or municipality on the owners or occupiers of property within their jurisdiction. In West Bengal, it is imposed in almost all districts and you need to pay on time to avoid late fees and fines.

The Department of Urban Development & Municipal Affairs of the West Bengal government has made it easier to pay your West Bengal property (holding) tax online through their official website holdingtax.co.in.

ADVERTISEMENT

This method is applicable for almost all municipal corporations in West Bengal, except Kolkata.

In this article, you will get to know the following points on how to pay your property (holding) tax online in West Bengal,

Let’s see each of these points in detail.

Details required to pay property tax in West Bengal

You will need the following details to pay Holding or property tax online,

- Name of your Municipal Corporation

- Mobile number

- Email ID

- Holding Number

ADVERTISEMENT

In case don’t remember your holding tax number, you will get it in any previous receipt of your holding tax payments. You can also find it online using the steps provided below.

Click to know the steps to find Holding Number online

Steps to pay property (holding) tax in West Bengal

To pay property tax in West Bengal,

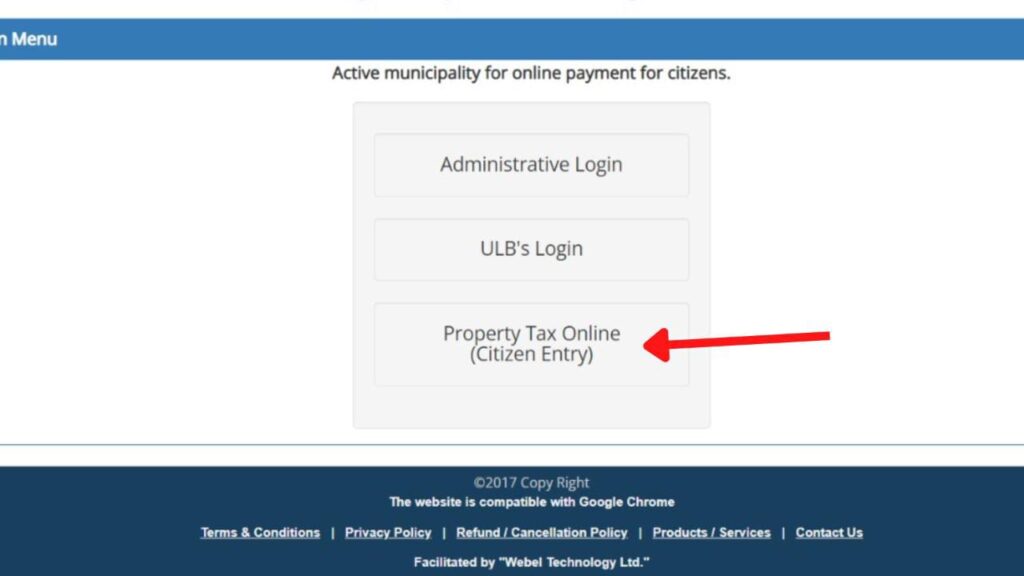

Step 1: Go to the official website of Holding Tax

- First, go to the official website of holding tax at holdingtax.co.in.

- Next, click the Property Tax Online (Citizen Entry) option.

- A pop-up window will appear on the screen.

(Direct link to the holding tax website)

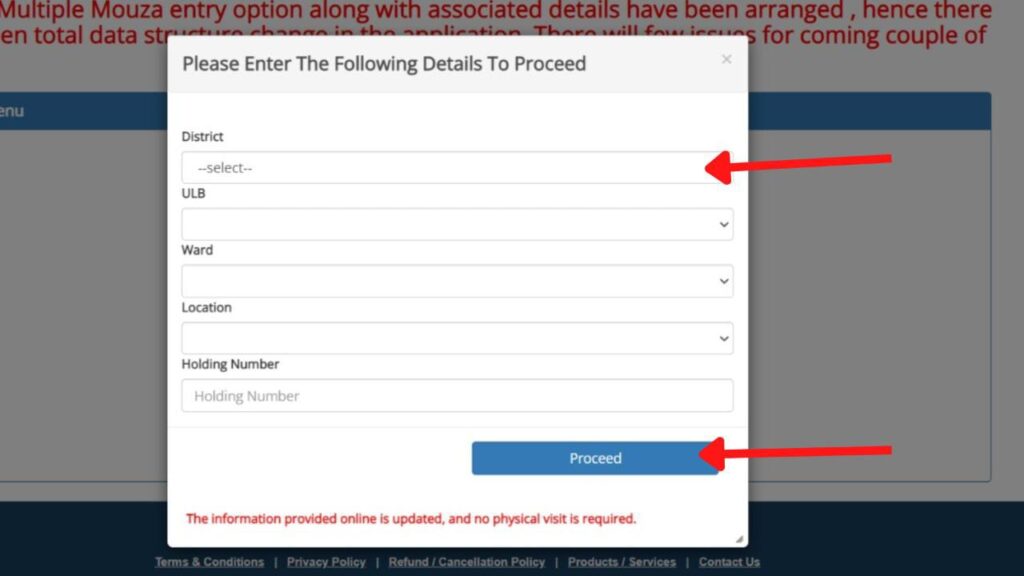

Step 2: Enter property details

- In the pop-up window, enter the district in which your property is situated.

- Next, select the UBL (Municipal Corporation and Municipality).

- Next, select your ward and location.

- Next, enter your holding number in the specified field.

- Next, click on the ‘Proceed‘ button.

- A new page will open.

ADVERTISEMENT

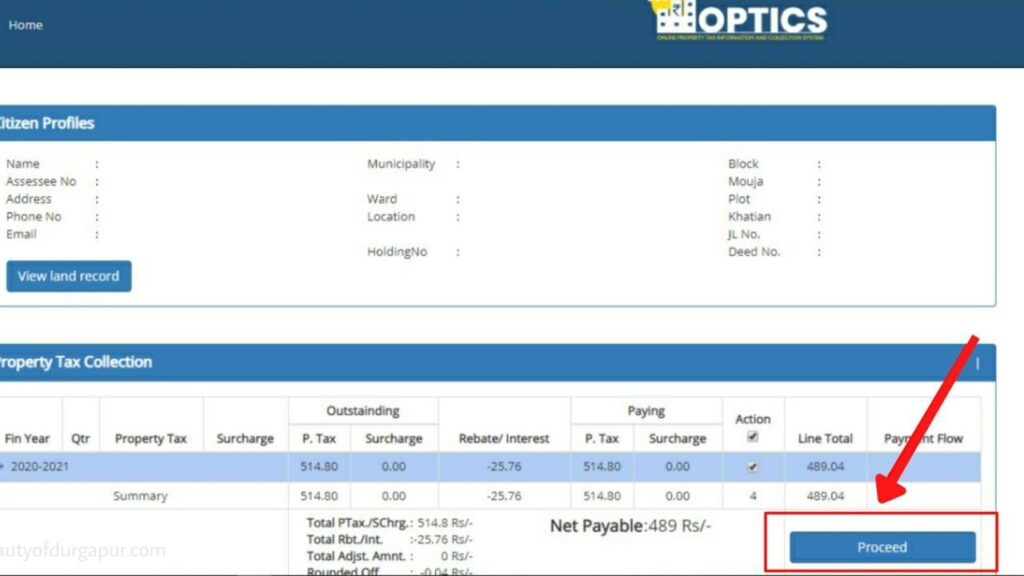

Step 3: Verify property details and tax

- On the new page, verify the details of your property.

- Next, check for the details of the payment that is pending. The details of the last few payments will also be given.

- After you have verified the amount pending, click on the ‘Proceed’ button.

Step 4: Complete payment

- Now, enter your email and mobile number in the specified field and select the payment gateway you want.

- Next, click on the ‘Complete Payment’ button. You will be redirected to a payment gateway.

- Choose any of the available modes of payment and follow the instructions on the screen to complete the payment process.

ADVERTISEMENT

Step 5: Print the receipt

- After payment completion, you will be redirected to a website where you will be asked to download your receipt.

- Next, click on the receipt and download it.

- Save it as PDF for further reference.

You can also take a printout for future reference

By following these steps, you can easily pay your property tax online of any municipal corporation online through

If you are from Kolkata, you can check how to pay Kolkata Municipal Corporation property tax in the article below.

Click to know the steps to pay KMC Property tax online.

More articles about Tax

- How To Check ITR Refund Status Online (In 4 Steps)

- How To Download Form 26AS (PDF) From Income Tax Portal

- How To Download Professional Tax Payment Certificate (PTPC) Online

- Property (Holding) Tax Payment Process In West Bengal

- Kolkata Municipal Corporation (KMC) Property Tax Payment Process