If you filed your Income Tax Return (ITR) and waiting for your refund, you can check its status online.

The Income Tax Department allows you to easily check your ITR refund status online through their official web portal at incometax.gov.in.

ADVERTISEMENT

The process is simple and takes just a few steps.

Steps to check ITR refund status online

To check your ITR refund status,

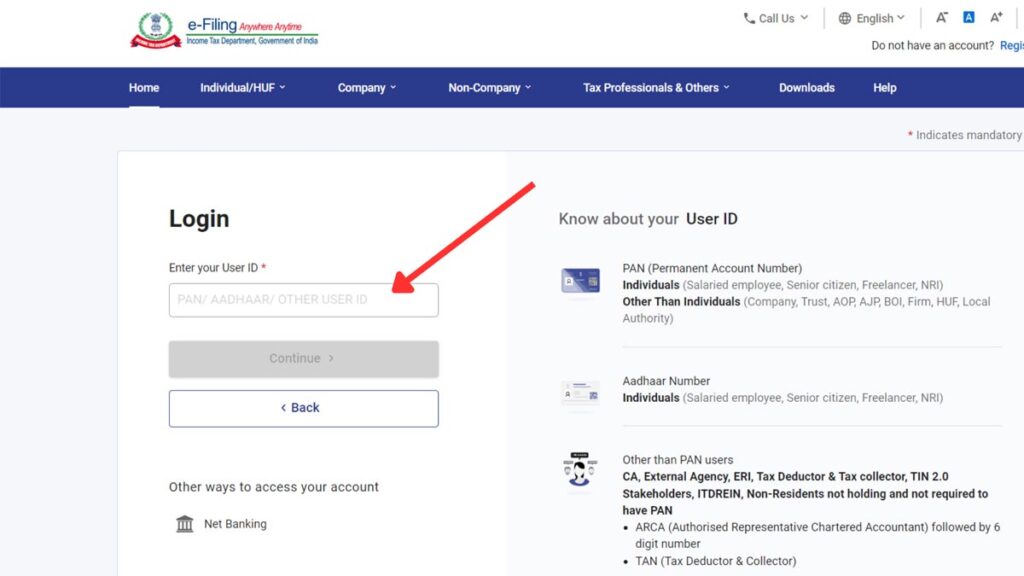

Step 1: Official website of the Income Tax Department

- First, go to the official website of income tax e-filing at incometax.gov.in.

- Next, click on the ‘Login’ button.

- Next, enter your PAN/AADHAAR/USER ID and click on the ‘Continue’ button.

- Next, tick the checkbox and enter your password in the specified field.

- Next, click on the ‘Continue’ button.

- You will be logged in successfully.

ADVERTISEMENT

You need to be registered on the Income Tax e-Filing portal to check your ITR refund status. In case you are not registered, create an account using the ‘Register’ option.

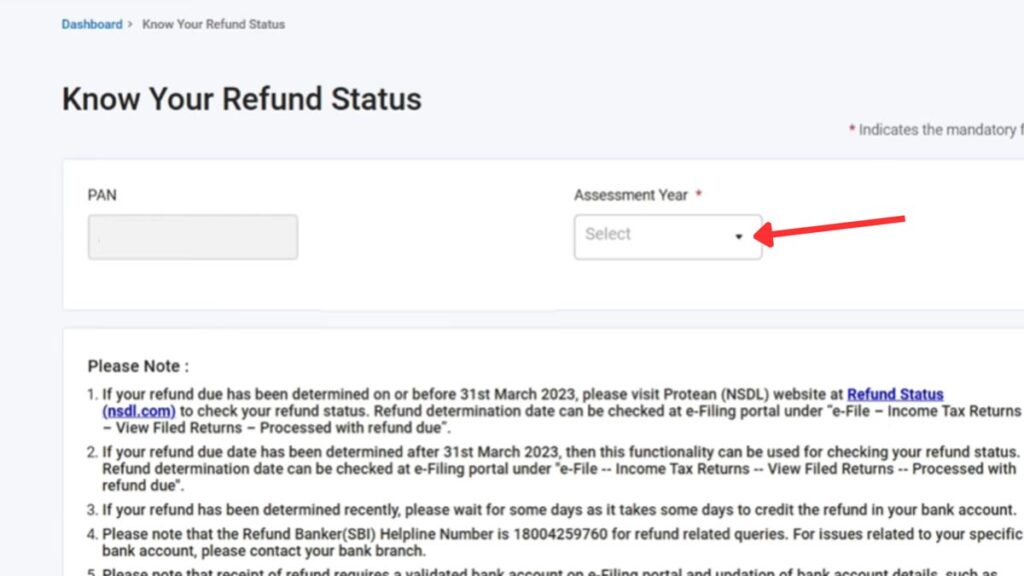

Step 2: Select ‘Assessment Year’

- Next, click on the ‘Services’ option from the top menu.

- Next, click on the ‘Know Your Refund Status’ option.

- Next, select the ‘Assessment Year’ from the given options.

- Next, click on the ‘Submit’ button.

- A new page will open.

Step 3: Check the ITR refund status

- All the details of the status will be shown on the screen.

- You can take a printout of the page if you want.

By following these steps, you can easily check the status of your ITR refund online.

More articles about Tax

- How To Check ITR Refund Status Online (In 4 Steps)

- How To Download Form 26AS (PDF) From Income Tax Portal

- How To Download Professional Tax Payment Certificate (PTPC) Online

- Property (Holding) Tax Payment Process In West Bengal

- Kolkata Municipal Corporation (KMC) Property Tax Payment Process