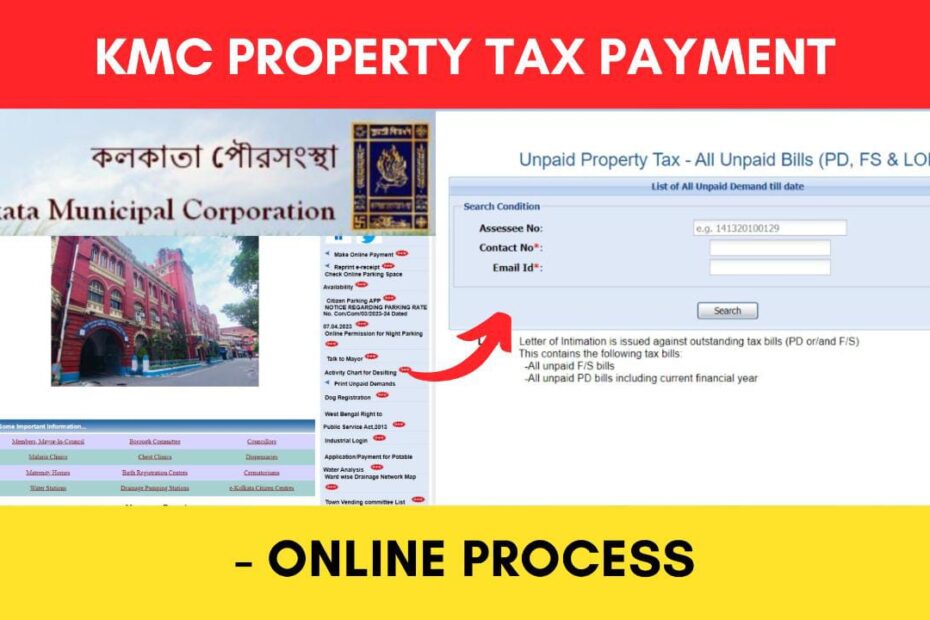

Property tax is imposed by KMC on the owners of properties within its jurisdiction. If you own a property in Kolkata, you can pay your property or holding tax from time to time to avoid penalties and interest charges.

The Kolkata Municipal Corporation (KMC) has made it easier to pay your property tax online through their official website www.kmcgov.in.

ADVERTISEMENT

You can also check your property tax details and download payment receipts through the portal.

In this article, you will get to know the following points on how to pay your property tax online in Kolkata,

Let’s see each of these points in detail.

Details required to pay KMC property (holding) tax online

The details required to pay your holding tax or property tax in Kolkata online are,

- A valid holding number or assessee number

- Your mobile number

- Your Email ID

ADVERTISEMENT

Steps to pay Kolkata Municipal Corporation (KMC) property tax online

To pay KMC property or holding tax online,

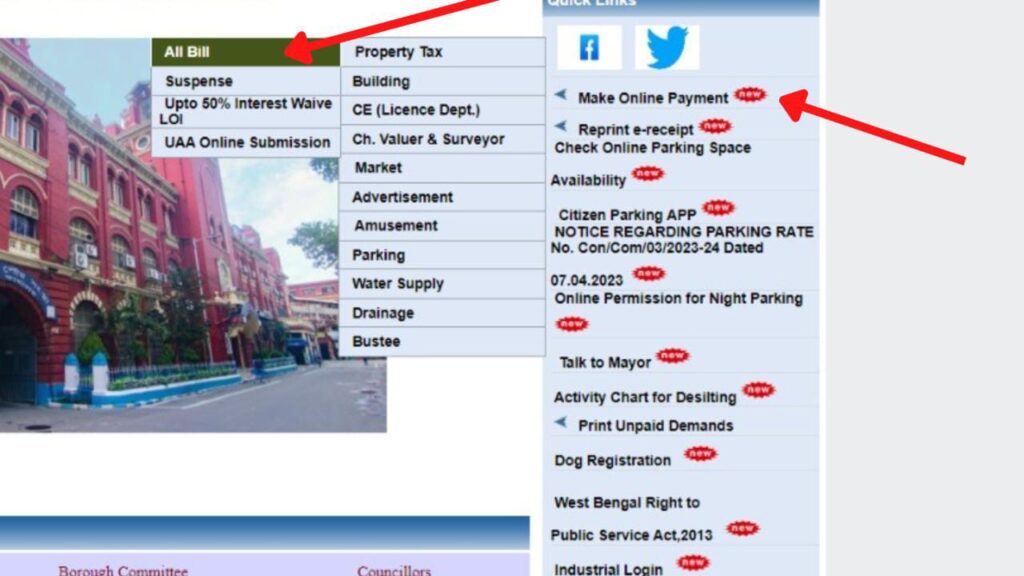

Step 1: Go to the official website of Kolkata Municipal Corporation

- First, go to the official website of KMC at kmcgov.in.

- Next, click on the ‘Make Online Payment’ option.

- Next, select the ‘Property Tax’ option.

- Next, from the options, select ‘All Bills.’

- A new page will open.

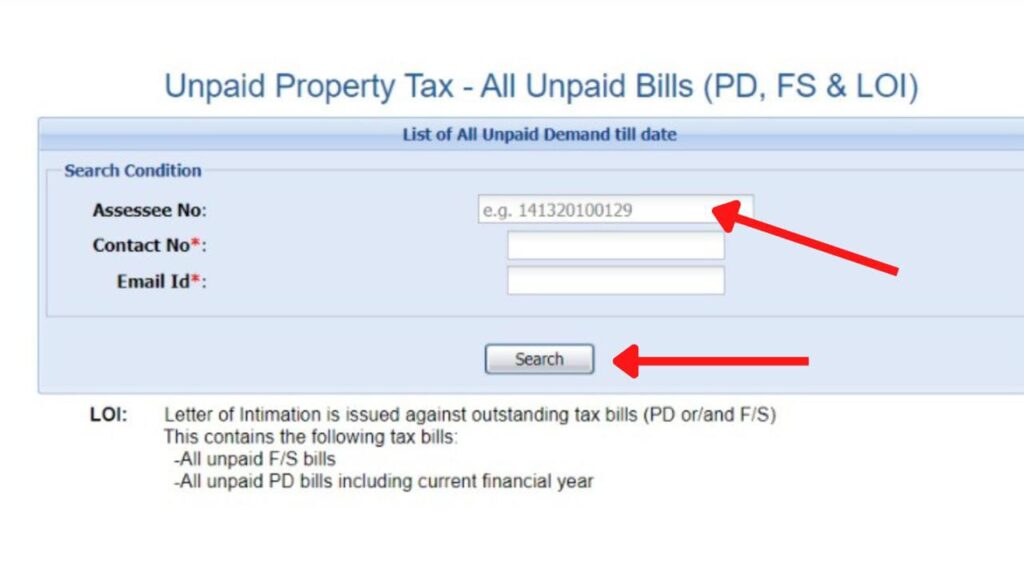

Step 2: Enter your details

- On the new page, enter your ‘assessee number.’ You can find it on your previous property tax bills.

- Next, enter your contact number and email id for verification and communication purposes.

- Next, click on the ‘Search’ button.

ADVERTISEMENT

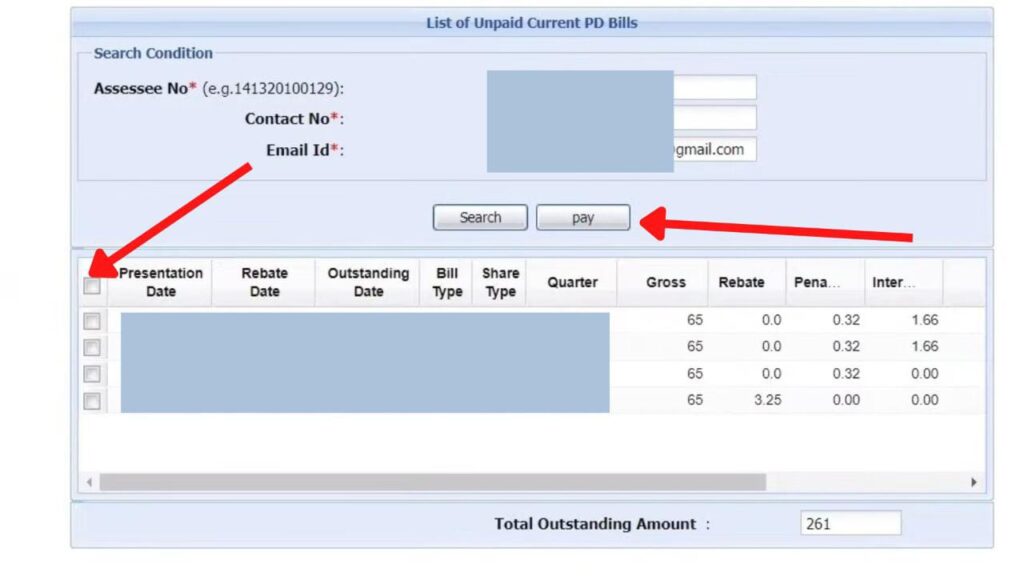

Step 3: Verify your property tax bill

- A page will all your pending bill details will be displayed on the screen.

- Check your property details, owner details, tax amount, rebate amount, interest amount, and total payable amount.

- If everything is correct, select the installments you want to pay by clicking on the checkboxes beside them.

- Next, click on the ‘Pay Now’ button.

Step 4: Complete property tax payment

- Now, select the payment gateway you want to pay with. You will be redirected to a payment gateway page.

- Next, choose the mode of payment. You can pay by debit card, credit card, net banking, or UPI.

- Next, follow the instructions on the screen and complete the payment.

ADVERTISEMENT

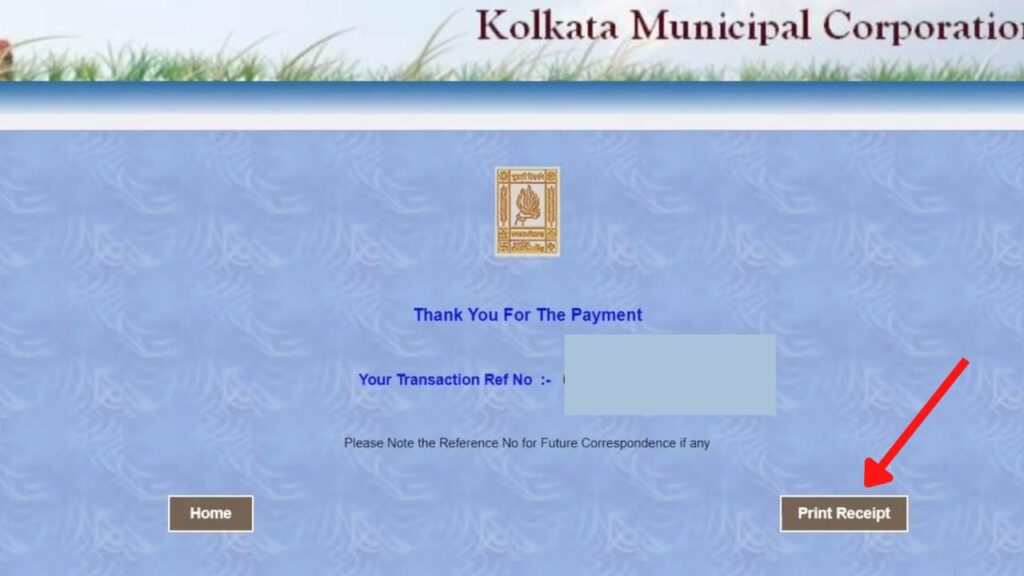

Step 5: Download the payment receipt

- After your payment is successful, a payment confirmation message will appear on the screen.

- Next, click on the ‘Print Receipt’ option.

- Next, save the e-receipt as PDF to download it.

You can also take a printout of the page for further reference.

By following these steps, you can easily pay your KMC Property Tax online through the official website of Kolkata Municipal Corporation at www.kmcgov.in.

In case you have not downloaded your payment receipt, you can do it at any time from the same portal.

More articles about Tax

- Property (Holding) Tax Payment Process In West Bengal 2023

- Kolkata Municipal Corporation (KMC) Property Tax Payment Process

- Road Tax Online Payment Process For Your Vehicle 2023

- How To Know The Road Tax Amount On Any Vehicle Online 2023

- Road Tax Payment Status Check For Your Vehicle Online 2023