If you are looking for a way to save tax and earn interest on your savings, you may consider opening an SBI tax-saving FD online. SBI tax-saving FD scheme is a type of fixed deposit that offers tax benefits under Section 80C of the Income Tax Act, 1961.

You can claim a deduction of up to Rs. 1.5 lakh from your taxable income by investing in this scheme. The interest rate on SBI tax-saving FDs maturing between 5 and 10 years is 5.5% for general customers and 6.3% for senior citizens.

ADVERTISEMENT

Opening an SBI tax-saving FD scheme online is very easy and convenient. You just need to have an SBI net banking account.

In this article, you will get to know the following points on how to open a tax-saving FD online in SBI,

Let’s see each of these points in detail.

Details required to open an SBI Tax Saving Fixed Deposit (FD)

You need the following details to open an SBI Tax Saving Fixed Deposit (FD) online,

- Internet Banking details

- Fixed deposit amount up to 1.5 lakhs

- Tenure of deposit (minimum 5 years)

- Registered mobile number

ADVERTISEMENT

Steps required to open an SBI Tax Saving Fixed Deposit (FD) Online

To open an SBI Tax Saving Fixed Deposit (FD) online,

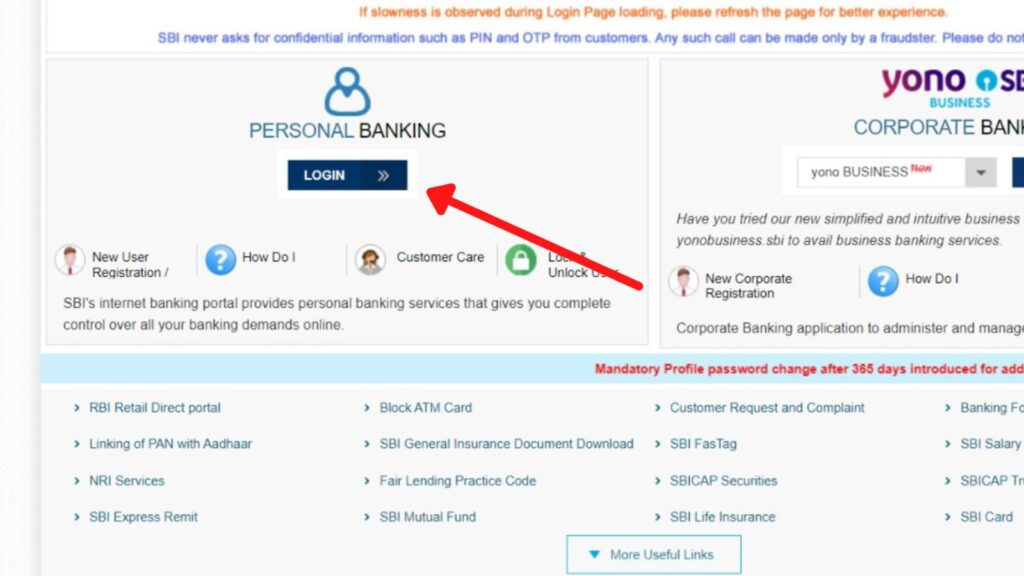

Step 1: Go to the official website of SBI Online

- First, go to the official website of SBI Internet Banking at onlinesbi.sbi

- Next, click on the ‘Login’ button under Personal Banking.

- Next, click on the ‘Continue to Login’ button.

- A new page opens up.

Step 2: Log in to your Internet Banking account

- On the new page, enter your internet banking username and password in the specified fields.

- Next, enter the captcha code and click on the ‘Login’ button.

- An OTP will be sent to your registered mobile number.

- Enter it in the specified field and click on the ‘Submit’ button.

- You will be logged in.

ADVERTISEMENT

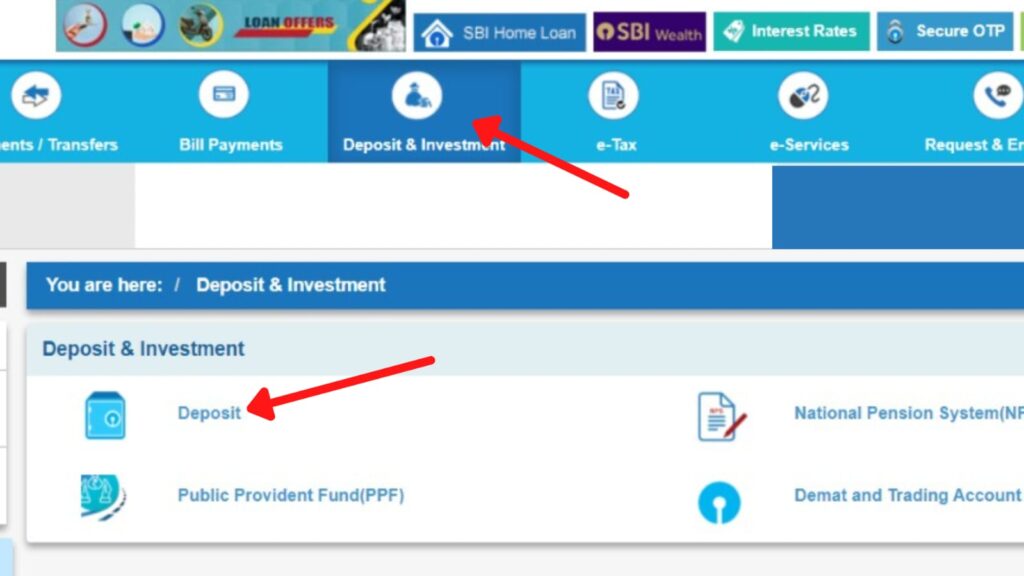

Step 3: Select the ‘Deposits & investments’ option

- Once logged in, click on the ‘Deposits & investments’ option on the main menu.

- Now click on the ‘Deposit’ option.

- A new page will open up.

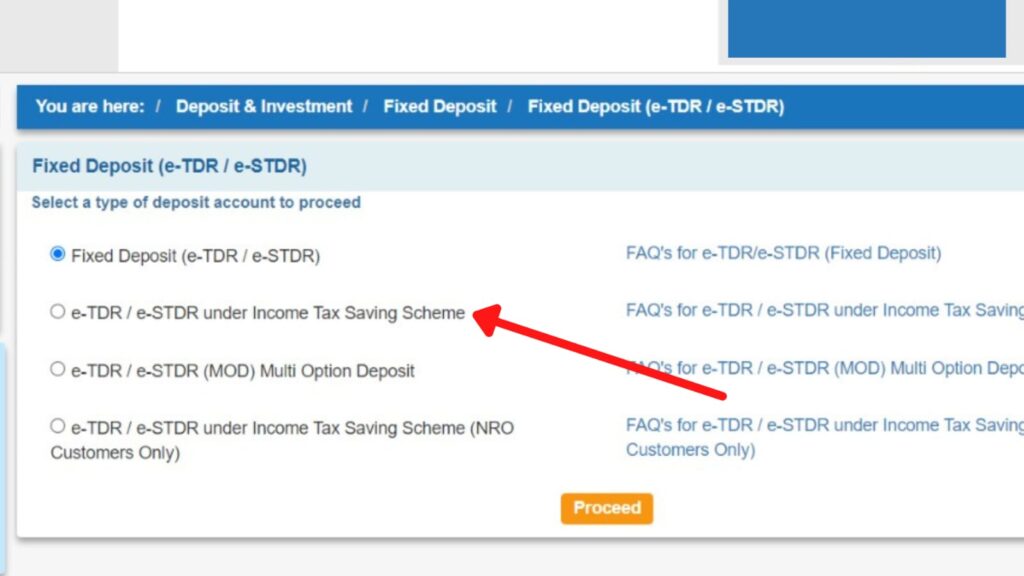

Step 4: Choose the ‘e-TDR/e-STDR under Tax Saving Scheme’ option

- Now, click on the Fixed Deposit (FD) option.

- Next, click on the ‘e-TDR/e-STDR under Tax Saving Scheme’ option.

- Next, click on the ‘Proceed’ button.

- A new page will open.

ADVERTISEMENT

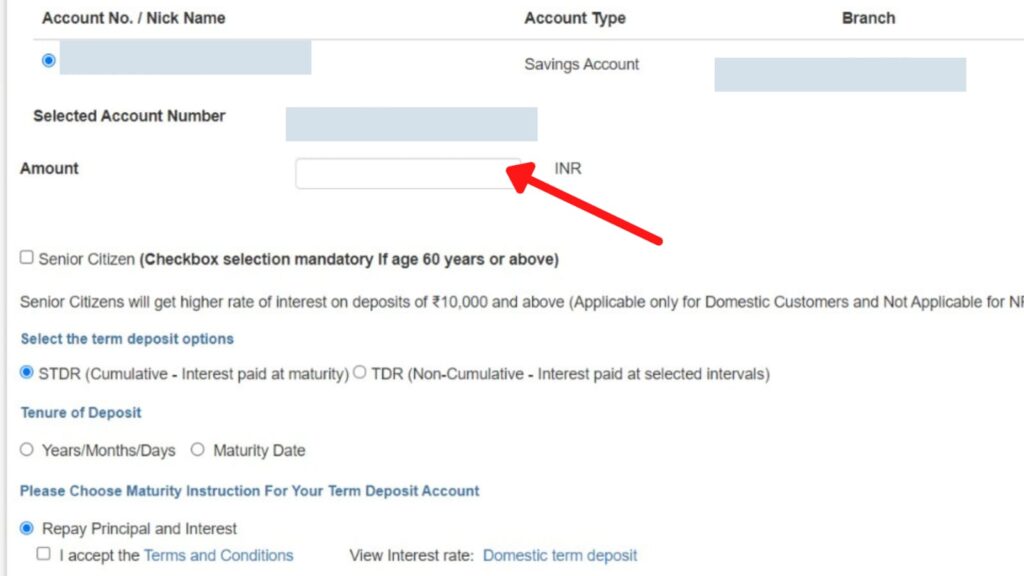

Step 5: Fill in the details

- Now, select the account from which you want the amount to be debited.

- Next, enter the amount for Fixed Deposit (FD) under the tax saving scheme.

- Now, select the term deposit options.

- Enter the fixed deposit tenure details. (Minimum 5 years)

- Next, fill out the remaining details based on the selection made.

Step 6: Create tax saving Fixed Deposit

- Once you have entered all the details, check the “I Accept the Terms and Conditions” checkbox.

- Next, click on the ‘Submit’ button.

- Now, verify the details entered by you.

- Next, click on the ‘Continue’ button.

Your request to create a fixed deposit under the Tax saving scheme will be successfully submitted.

By following these steps, you can easily create a Fixed deposit account online through the official net banking portal onlinesbi.sbi.

ADVERTISEMENT

In addition to this, you can also opt for other tax-saving schemes provided by the government like PPF and NPS.

More articles about Investments

- How To Redeem SBI Mutual Fund Amount (Via Portal & App)

- How To Pause or Cancel SBI Mutual Fund SIP (Via Portal & App)

- How To Cancel HDFC Mutual Fund SIP Online

- How To Activate (Enable) Auto Sweep Facility In SBI Online

- How To Close (Break) Fixed Deposit In SBI Online

- How To Download SBI Fixed Deposit (FD) Receipt Online